Published 11th May 2023

In our previous article, we shared how communities around the world have built their daily lives around infrastructure. Infrastructure refers to the physical assets and systems that provide basic services to society in order to function smoothly. Infrastructure companies invest into these assets that provide such services and systems, including utilities, transport, and communication assets.

Infrastructure Investments

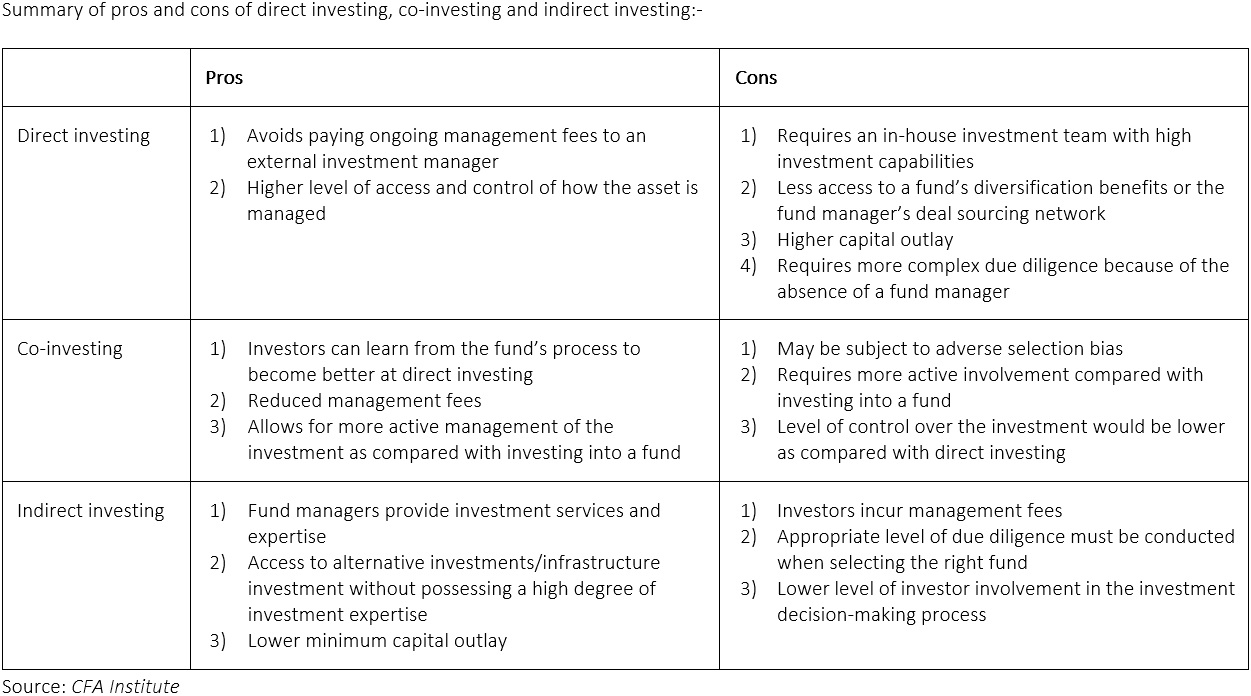

The three main approaches when it comes to infrastructure investing are:-

- Direct investment;

- Indirect investment; or

- Co-investments

Each of these approaches carries its potential risks and returns. Deciding on one will also affect the due diligence process, which is necessary when investing in infrastructure. In this regard, these different approaches could highlight different types of operational, financial, counterparty and liquidity risks for investors.

Direct Investments

Direct asset investments, where investors gain direct exposures to the tangible infrastructure or renewable energy assets (without the use of an intermediary), typically involve long-term direct commitment of capital, and investors are usually required to be directly involved in the management and operations of these assets. Direct investment into infrastructure offers investors comparatively better access and control of how the asset is managed. Whilst direct investment in infrastructure assets could be yielding higher returns and rewards, it necessitates the need for significantly more involvement on day-to-day basis with the management of the asset. Aside from this, direct asset investment may also involve higher legal and tax complexity, and lengthy planning processes. Last but not least, direct investments typically require higher minimum capital requirements. This can be resource-consuming as it requires a high level of specialization and expertise.

For example, owning a wind farm or solar power plant directly requires the investors to manage the projects’ operational and maintenance activities on a daily basis. Investors must ensure that the equipment are working optimally, and the project is generating maximum output. It also requires compliance with regulations and permits, which can be complex at times, especially in different geographical locations. Additionally, investors must assess and mitigate risks that may arise during the project lifecycle, such as weather and natural disasters.

Nevertheless, despite the higher degree of operational need, complexity, and illiquidity contributing to higher risk; direct asset investments generally offer higher potential returns, greater control, and closer proximity to the source of the cash flow of the business, as compared to indirect investments.

Indirect Investments

On the other spectrum is the indirect investments, where typically investments are conducted through fund investing, whereby an investor contributes capital to a fund and the fund identifies, selects, and makes investments on the investor’s behalf. In consideration of such services, the investor is charged a fee based on the amount of the assets being managed, and a performance fee is applied if the fund manager delivers in excess of the agreed return. Fund investing is ideal for financial investors or investors with limited resources and/or experience, as well as deal sourcing capabilities and network in infrastructure space. That said, investors will have lesser control in the investment decision making and fund investors generally do not involve substantially in the fund’s underlying decisions vis-à-vis direct investing.

Co-investing

Once investors have some experience investing in funds, and prior to investing directly themselves, they can gain further investing experience via co-investing, where the investor invests in assets indirectly through the fund but at the same time also invests directly in the same assets alongside the fund. Through co-investing, investors can learn from the fund’s process to become better at direct investing. Co-investments also allow for reduced management fees. On the flip side, co-investors could be subject to adverse selection bias, depending on the investment which the fund manager introduces to the investor. In addition, co-investing requires more active involvement compared with indirect investments, which can be challenging for some investors.

With the above pros and cons in mind, Infrastructure Funds would be a suitable approach for investors, especially given the level of sophistication required in infrastructure investing.

Infrastructure Funds

Infrastructure funds refer to fund of investments which emphasizes on assets within sectors that build up the nation’s infrastructure. This includes investing in public assets and services that people rely on to live, work and travel.

Infrastructure funds typically buy direct stakes into infrastructure companies / assets, and would often have a say in their operational management. Hence, the infrastructure funds via its fund managers (who are mandated to act on behalf and for its investors) may be able to exert material level of influence and a degree of control over the management of the infrastructure company / asset (especially over material matters such as capital structure and business development).

Why Infrastructure Funds are an ideal investment vehicle for investors

Infrastructure investments as an assets class comes with many attractive qualities (including but not limited to stable cashflow, inflation protection, and benefit of diversification), which we have shared in our previous series. However, direct investment in infrastructure assets requires expertise and experience in selection, operation, and management of investments. Network and familiarity with the industry are also important to gain access to good investment opportunities. For most investors, direct asset investments usually translate to lack of diversification due to higher investment ticket size or each investment.

As an alternative, some investors consider investing in equities of listed infrastructure companies instead, which usually have the benefit of potentially providing better liquidity and diversification to the investors’ portfolio, as well as ease of acquiring and disposal access channels, through the stock exchanges. Despite the flexibility benefits through investment in stocks and shares of publicly listed companies, this method of investment generally is often considered to provide lower potential returns and minimal level of control, as compared to a direct asset investment. In addition, investors’ potential returns through purchase of public equities are also exposed to market volatility.

Investing in infrastructure funds offer the best of both worlds. Fund managers specializing in infrastructure investments can help investors mitigate the risks of lower day-to-day involvement in infrastructure assets and their management as a check and balance, while still enjoying the benefits of direct infrastructure investment, such as proximity to cashflow. Infrastructure funds also offer a wide range of investment opportunities, including equity and debt instruments, and can be tailored to meet specific investor needs. As compared with investment in public equities, the pre-agreed investment mandate can be tailored to suit the specific needs of the investors, and hence, are more precise and prescriptive. On top of offering expertise in sourcing, selecting, operating, and managing infrastructure assets, fund managers also work alongside company management at the investee level to create value via active investing.

Key takeaways

- When it comes to investing in infrastructure, there are three main approaches: (i) direct investment, (ii) indirect investment, and (iii) co-investments. There are pros and cons for each investment approach and each approach depends on investors’ specific goals and risk tolerance levels.

- Through an infrastructure fund, investors can gain access to the fund managers’ investment services and expertise, with the inherent risks being professionally managed by the fund manager’s dedicated teams to monitor and manage the operations of the infrastructure assets. Optimization of the investments could result in better yields and returns.

- Without possessing a higher degree of investment expertise, investors are also able to rely and tap on the technical know-how, experience, and track record of the fund manager in infrastructure investments.

- Infrastructure funds can be highly flexible and able to offer a wide range of investment opportunities against differing investment appetites, which include flexibility to also format the funds as equity- and debt-fund, in order to meet specific risk-reward profiles of investors.

- In addition, the pre-agreed investment mandates and policies which govern such funds is expected to stay within its investment intentions and accordingly, minimize the risk of deviating from the investment strategy.

- Given interests alignment, fund managers are incentivized to also look at value creation opportunities via active engagement with the management of the asset company, to enhance value at asset level.

Farosson Group Disclaimer

This publication and/or the materials herein prepared are solely for information or educational purposes only and should not be treated as research or advice. This publication may not be published, circulated, reproduced, distributed, transmitted, or otherwise communicated to any other person, in whole or in part, without our express written consent. No guarantee, representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the markets or developments referred to in this publication and/ or the materials herein.

This publication and/ or the materials herein should not be regarded by the recipients as a substitute for the exercise of their own judgement and the recipients should not act on the information contained herein without first independently verifying its contents. Any opinions or estimate expressed in this report are subject to change without notice and may differ or be contrary to opinions expressed by others as a result of using different assumptions and criteria. Farosson Pte. Ltd., Farosson Capital Pte. Ltd. and its related companies (collectively known as “Farosson Group”), have not given any consideration to and has not made any investigation of the investment objectives, financial situation or particular needs of the recipient, and accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of the recipient acting on such information or opinion or estimate.

This publication may contain projections, estimates, forecasts, targets, opinions, prospects, results, returns and forward-looking statements ("forward-looking statements") with respect to Farosson Group and its related group of companies future performance, position and financial results. Examples of forward-looking statements include statements made or implied about the Farosson Group's and its related group of companies’ strategy, estimates of sales growth, financial results, cost savings and future developments in its existing business and the Farosson Group's and its related group of companies’ financial position. Statements of future events or conditions in this publication, including projections, sustainability framework plans, sensitivity analyses, expectations, estimates, the development of future technologies, and business plans, are forward-looking statements. Actual future results or conditions, including: demand growth and relative energy mix across sources, economic sections and geographic regions; the impacts of waves of COVID-19; the impact of new technologies; changes in law or government policy, the actions of competitors and customers; including the occurrence and duration of economic recessions; unforeseen technical or operational difficulties; the pace of regional or global recover from the COVID-19 pandemic and actions taken by governments or consumers resulting from the pandemic.

Farosson Group is under no obligation to update or keep current the information contained herein. In no event and under no legal or equitable theory, whether in tort, contract, strict liability or otherwise, shall Farosson Group be liable for any damages, including without limitation direct or indirect, special, punitive, incidental or consequential damages, losses or expenses (including loss of profits) arising in connection with the use of or reliance on the information contained herein, even if notified of the possibility of such damages, losses or expenses.