Published 31st March 2023

Investing in infrastructure assets is an effective way to benefit from stable income and cash flows, as well as capital growth and appreciation in the longer run. In the past, the infrastructure asset class has typically been more accessible to institutional-type participants and investors with longer-term investment horizons. However, in more recent times, such investments are being availed to non-institutional investors (e.g. high-net-worth individuals) as well through financial products like trusts and funds.

Our most recent article in this knowledge-sharing series explained what infrastructure is in modern society. In this article, we share some insights into the exciting topic of Infrastructure Investing.

Infrastructure Investing?

To recap, infrastructure investing refers to investments in real physical assets, which are essential to society. Infrastructure assets vary from transport assets to roads and bridges, from schools to hospitals, as well as power, energy and utility generation facilities, and digital infrastructure. Typically, these are assets that retain key characteristics such as long-term concessions, high barriers to entry and low competition. Coupled with contractual revenue streams, often from contracts with government or counterparties with high credit ratings, infrastructure investments can enhance an investor’s portfolio with stable and consistent returns.

Infrastructure investments can be analysed in various dimensions, as follows:-

i) Stage of development

ii) Geography

iii) Form of investment

iv) Risk/return profile

Infrastructure by Stage of Development

- Infrastructure investments can be categorised by the asset’s stage of development, namely greenfield and brownfield.

- Greenfield investment refers to assets that are to be constructed or under construction. The investment intention could be to hold and/or to operate the assets over the long term or for a period of time until a sale to new investors. The sale would generally command capital appreciation to reflect the development, construction and commissioning risks undertaken.

- Investing in existing infrastructure assets, on the other hand, is referred to as brownfield investment. Typically, the assets are operational, with proven operating and financial track records. Brownfield investors may include strategic investors who specialise in the operation of the underlying assets. These investments also attract financial investors who are keen to reap the anticipated long-term stable returns.

Infrastructure By Geography

- Infrastructure investing must also be considered from a geographical perspective, as different locations present different risks and offer varying returns.

- The geographic locations of the underlying assets will indicate the political and macroeconomic risks involved.

- Countries with similar risk profiles may be grouped into wider categories known as ‘developed markets’ and ‘emerging markets’.

- Hence, multi-jurisdiction infrastructure investing would introduce varying uncertainties as well, such as currency risk, political risk, as well as profit-repatriation risk.

- Thus, a key consideration for investors and asset managers would be to ensure that these risks are appropriately covered and managed, such as through procurement of insurances, financial instruments, and other available mechanisms.

Form of Infrastructure Investments

Infrastructure investments can take various forms, with each form having its respective liquidity, cash flow and income streams characteristics.

a. Direct Investments

- Direct investment typically offers control and opportunity to benefit from the full value of the asset.

- However, significant investments are required, resulting in concentration and liquidity risks.

- Many direct investments are hence undertaken by a consortium of experienced partners who are able to co-leverage on each other to better manage certain risks, or with other financial / institutional investors to limit single concentration exposures.

b. Indirect Investments

- On the other hand, there are other investors who choose to invest indirectly.

- Such indirect vehicles include the likes of infrastructure funds, infrastructure Exchange Traded Funds, and via equities / shares of companies.

- These investments offer different asset strategies, including equity, debt and mezzanine investments.

- Investors who require flexibility and have liquidity concerns may instead opt for publicly traded infrastructure securities or master limited partnerships (MLPs).

Risks and Returns Profile

Risks and returns of investing in infrastructure would differ from asset to asset, depending on the asset’s underlying category, stage of development / lifecycle as well as geographic location. Additionally, the form of investment also determines the risks and expected returns from the investment.

As an example, publicly traded infrastructure securities typically have the benefit of liquidity, transparent governance, market prices, and portfolio diversification among underlying assets. However, returns from publicly traded infrastructure securities could arguably, at times, be capped by wider market forces beyond the asset itself.

On the other end of the spectrum, a direct investment into the underlying infrastructure assets provides the investors with certainty of control, management and the opportunity to capture and benefit from the full value of the infrastructure assets. However, such direct investments involve much larger investment outlays, which tend to result in higher concentration and liquidity risks to the investors.

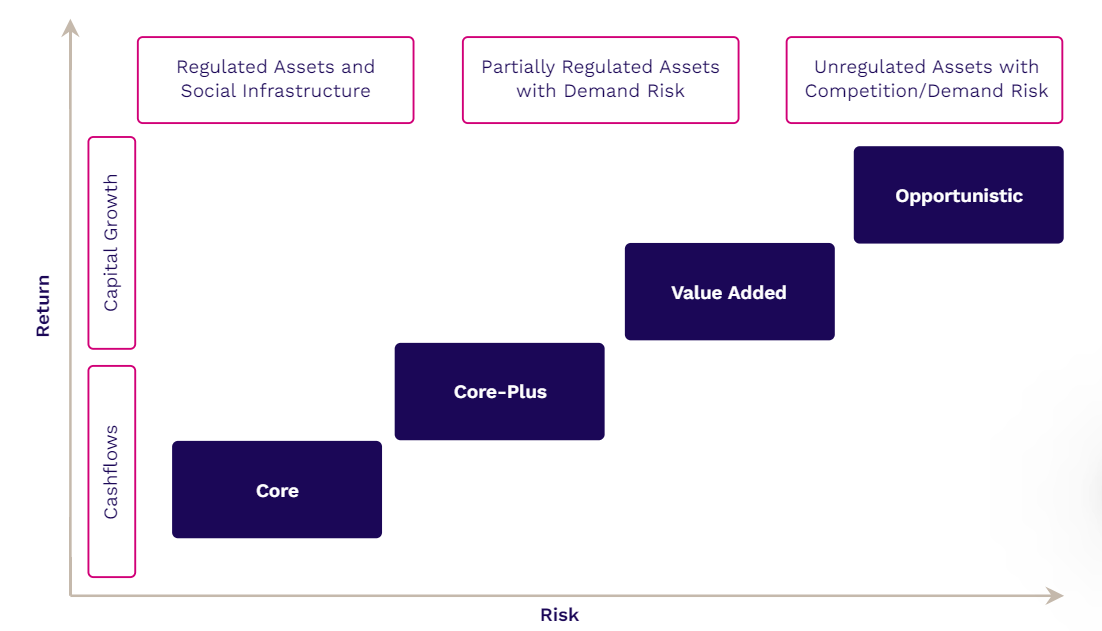

Typically, infrastructure investing is divided into four main risk categories: (i) core, (ii) core-plus, (iii) value-added and (iv) opportunistic. These are commonly accepted classifications used by investors to assist in portfolio construction and ensure appropriate diversification when allocating to the asset class¹.

i. Core infrastructure is considered the most stable form, as these assets tend to be largely de-risked and brownfield in nature. Returns are generally derived from income with limited upside through capital gains, and assets are commonly held for the longer term (more than seven years). Revenues and cash flow are generally governed by either rate regulation, availability agreements (which provide for the payment of revenue as long as a facility is able to operate) or long-term contracts with highly creditworthy counterparties. Examples include gas, electric, water/waste and multi-utilities, contracted and renewable power generation and mature, top-tier airports, seaports or toll roads in major markets.

ii. Core-plus infrastructure have some similarities with core infrastructure; however, there is generally more variability associated with the cash flows of core-plus assets. Income is still a component of overall returns, but there is also scope for greater capital appreciation. The holding period for core-plus assets is typically more than six years. Core-plus infrastructure still primarily consists of brownfield assets. These assets are typically less monopolistic than core infrastructure and may include a growth or escalation component. Examples include contracted renewable power generation with some development risk, contracted oil and gas midstream assets as well as toll roads, airports, seaports with greater sensitivity to GDP.

iii. Value-added infrastructure typically include less monopolistic assets, assets that have a material growth, expansion or repositioning orientation, and certain greenfield assets. The holding period for value-added infrastructure is generally shorter than for core-plus infrastructure and typically ranges from five to seven years. Returns are primarily from capital appreciation rather than ongoing income. Examples include greenfield assets under construction, upstream oil and gas, data centres and fibre optic networks and assets undergoing meaningful expansion or repositioning.

iv. Opportunistic infrastructure have the highest degree of risk but also have the highest return potential. Assets can include those in development, those located in emerging markets, those subject to a high degree of volumetric or commodity price exposure, or those under financial distress and in need of significant repositioning. In general, opportunistic infrastructure assets share many characteristics with private equity investments. Holding periods typically range from three to five years, and returns are almost entirely from capital appreciation. Examples include infrastructure assets in developing markets, special situations, such as assets undergoing transition or financial distress, merchant power generation or merchant oil and gas midstream processing assets.

¹ Reference: https://www.mercer.com/content/dam/mercer/attachments/global/gl-2021-infrastructure-a-primer.pdf

Source: Preqin, accessed 31 March 2023,

https://cdn.ihsmarkit.com/www/pdf/0322/IHSMarkit_PrivateDebtWhitePaper.pdf

*** Follow us on LinkedIn @Farosson for the next topic(s) within this knowledge sharing series. Stay tuned. ***

Farosson Group Disclaimer

This publication and/or the materials herein prepared are solely for information or educational purposes only and should not be treated as research or advice. This publication may not be published, circulated, reproduced, distributed, transmitted, or otherwise communicated to any other person, in whole or in part, without our express written consent. No guarantee, representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the markets or developments referred to in this publication and/ or the materials herein.

This publication and/ or the materials herein should not be regarded by the recipients as a substitute for the exercise of their own judgement and the recipients should not act on the information contained herein without first independently verifying its contents. Any opinions or estimate expressed in this report are subject to change without notice and may differ or be contrary to opinions expressed by others as a result of using different assumptions and criteria. Farosson Pte. Ltd., Farosson Capital Pte. Ltd. and its related companies (collectively known as “Farosson Group”), have not given any consideration to and has not made any investigation of the investment objectives, financial situation or particular needs of the recipient, and accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of the recipient acting on such information or opinion or estimate.

This publication may contain projections, estimates, forecasts, targets, opinions, prospects, results, returns and forward-looking statements ("forward-looking statements") with respect to Farosson Group and its related group of companies future performance, position and financial results. Examples of forward-looking statements include statements made or implied about the Farosson Group's and its related group of companies’ strategy, estimates of sales growth, financial results, cost savings and future developments in its existing business and the Farosson Group's and its related group of companies’ financial position. Statements of future events or conditions in this publication, including projections, sustainability framework plans, sensitivity analyses, expectations, estimates, the development of future technologies, and business plans, are forward-looking statements. Actual future results or conditions, including: demand growth and relative energy mix across sources, economic sections and geographic regions; the impacts of waves of COVID-19; the impact of new technologies; changes in law or government policy, the actions of competitors and customers; including the occurrence and duration of economic recessions; unforeseen technical or operational difficulties; the pace of regional or global recover from the COVID-19 pandemic and actions taken by governments or consumers resulting from the pandemic.

Farosson Group is under no obligation to update or keep current the information contained herein. In no event and under no legal or equitable theory, whether in tort, contract, strict liability or otherwise, shall Farosson Group be liable for any damages, including without limitation direct or indirect, special, punitive, incidental or consequential damages, losses or expenses (including loss of profits) arising in connection with the use of or reliance on the information contained herein, even if notified of the possibility of such damages, losses or expenses.